The Only Guide for Eb5 Investment Immigration

Top Guidelines Of Eb5 Investment Immigration

Table of ContentsEb5 Investment Immigration for DummiesSome Of Eb5 Investment ImmigrationSome Known Factual Statements About Eb5 Investment Immigration How Eb5 Investment Immigration can Save You Time, Stress, and Money.Not known Details About Eb5 Investment Immigration

While we make every effort to offer exact and up-to-date material, it should not be considered legal guidance. Migration regulations and regulations undergo alter, and private scenarios can differ widely. For individualized support and legal advice concerning your specific migration situation, we strongly recommend talking to a certified migration lawyer who can give you with customized assistance and guarantee compliance with existing laws and guidelines.

Citizenship, with financial investment. Presently, as of March 15, 2022, the amount of investment is $800,000 (in Targeted Employment Locations and Country Areas) and $1,050,000 elsewhere (non-TEA zones). Congress has authorized these amounts for the next 5 years starting March 15, 2022.

To receive the EB-5 Visa, Investors should develop 10 permanent united state tasks within two years from the date of their complete financial investment. EB5 Investment Immigration. This EB-5 Visa Demand ensures that financial investments add directly to the U.S. job market. This applies whether the jobs are developed directly by the business or indirectly under sponsorship of a marked EB-5 Regional Center like EB5 United

The 10-Second Trick For Eb5 Investment Immigration

These jobs are established through versions that utilize inputs such as development prices (e.g., building and equipment expenses) or annual incomes produced by ongoing operations. On the other hand, under the standalone, or direct, EB-5 Program, only direct, full-time W-2 employee settings within the commercial business might be counted. A vital risk of depending solely on direct employees is that personnel reductions as a result of market problems can result in inadequate full-time settings, potentially resulting in USCIS denial of the capitalist's petition if the work development demand is not satisfied.

The financial model after that projects the number of direct jobs the brand-new organization is likely to develop based upon its expected earnings. Indirect tasks calculated with financial models describes employment generated in sectors that supply the items or services to business directly involved in the project. These jobs are produced as a result of the raised demand for products, materials, or services that support business's procedures.

The Ultimate Guide To Eb5 Investment Immigration

An employment-based 5th preference category (EB-5) financial investment visa gives an approach of ending up being an irreversible united state check that resident for international nationals intending to invest capital in the USA. In order to apply for this environment-friendly card, an international investor has to spend $1.8 million (or $900,000 in a Regional Center within a "Targeted Employment Location") webpage and produce or preserve at the very least 10 full time tasks for USA workers (excluding the investor and their immediate household).

This measure has actually been a tremendous success. Today, 95% of all EB-5 resources is elevated and invested by Regional Centers. Considering that the 2008 monetary situation, access to capital has actually been restricted and local spending plans remain to deal with considerable deficiencies. these details In lots of regions, EB-5 financial investments have actually loaded the financing void, giving a brand-new, vital source of capital for neighborhood financial advancement jobs that revitalize communities, create and sustain work, infrastructure, and solutions.

10 Simple Techniques For Eb5 Investment Immigration

More than 25 nations, including Australia and the United Kingdom, usage comparable programs to attract foreign financial investments. The American program is more strict than many others, needing considerable threat for financiers in terms of both their monetary investment and migration standing.

Family members and individuals that seek to relocate to the United States on an irreversible basis can apply for the EB-5 Immigrant Investor Program. The United States Citizenship and Immigration Services (U.S.C.I.S.) established out various requirements to get long-term residency with the EB-5 visa program.: The very first action is to discover a certifying financial investment possibility.

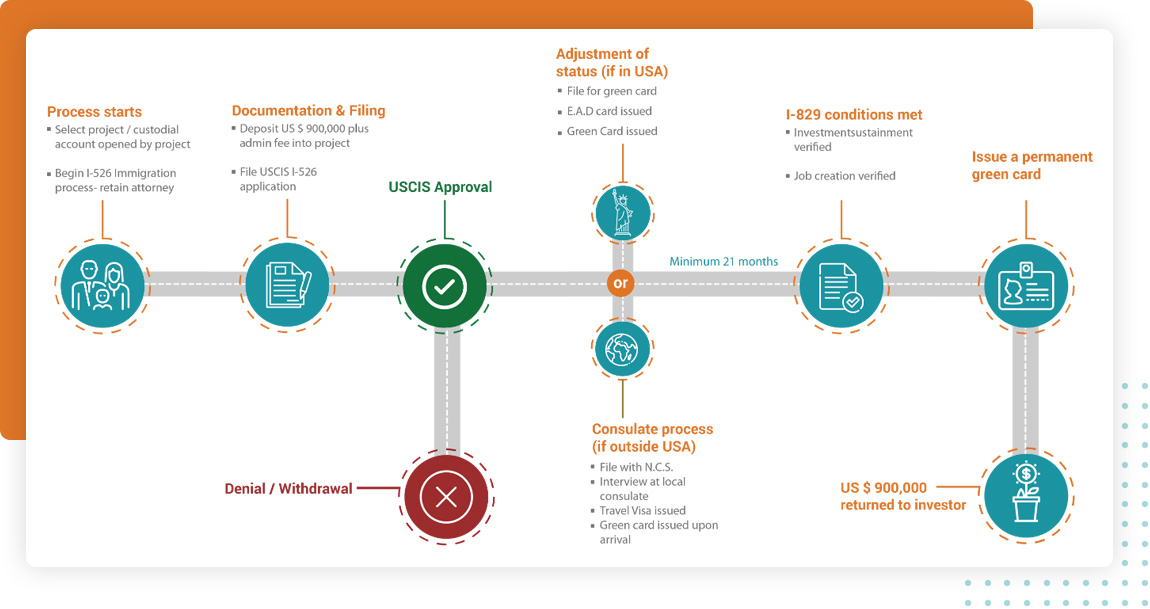

As soon as the possibility has been identified, the investor should make the investment and send an I-526 application to the U.S. Citizenship and Migration Provider (USCIS). This application needs to include proof of the financial investment, such as financial institution declarations, purchase contracts, and business strategies. The USCIS will review the I-526 petition and either approve it or request additional proof.

Getting My Eb5 Investment Immigration To Work

The investor must get conditional residency by submitting an I-485 application. This request should be sent within 6 months of the I-526 approval and need to include proof that the financial investment was made and that it has actually developed at the very least 10 permanent tasks for united state employees. The USCIS will certainly evaluate the I-485 request and either approve it or demand additional evidence.